- Halal Legacy Shield

- Posts

- ⚖️ Jurisdictional Conflict: Why the Islamic Revocable Trust is the Apex Tool for Sharia-Compliant Wealth Transfer

⚖️ Jurisdictional Conflict: Why the Islamic Revocable Trust is the Apex Tool for Sharia-Compliant Wealth Transfer

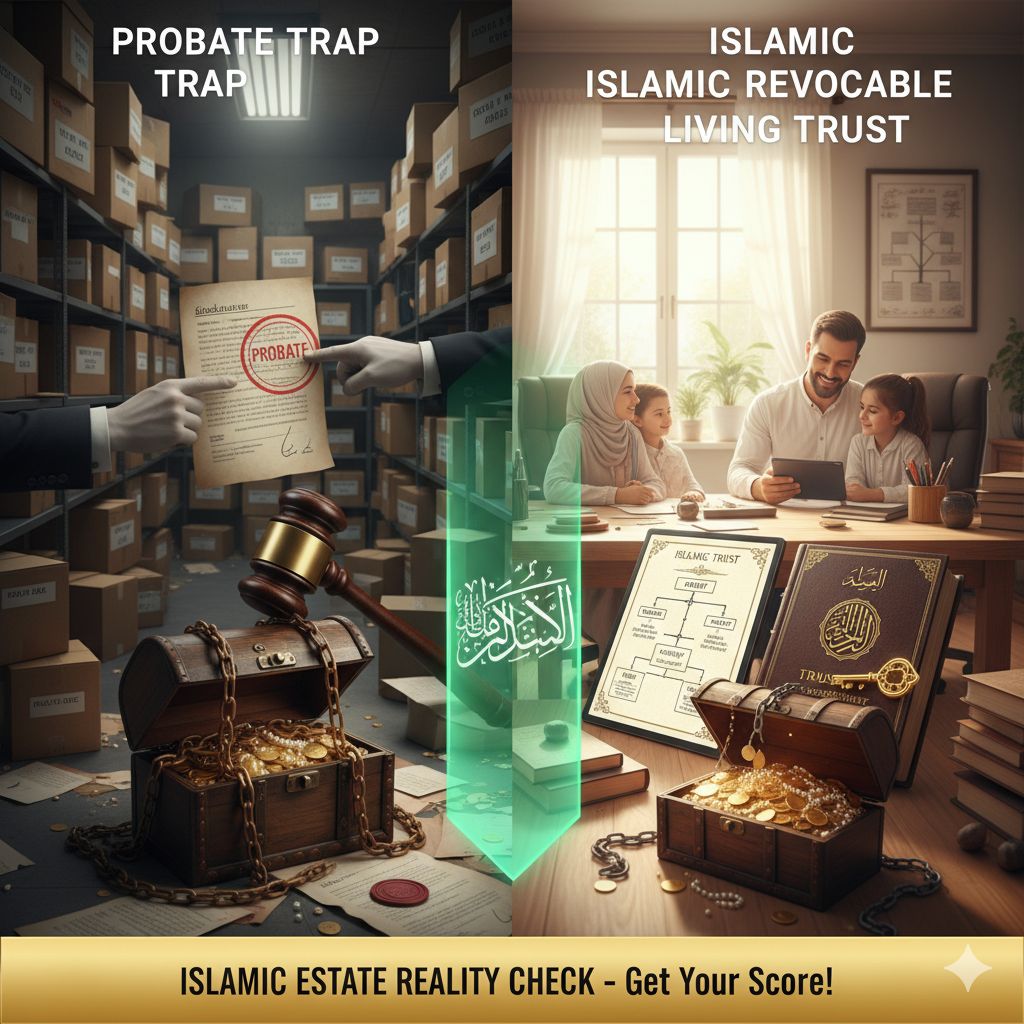

The Strategic Solution: Avoiding the Costly Probate Trap with an Islamic Revocable Living Trust.

Assalamu Alaikum

Dear Legacy Builders! 👋

When Faith Meets the Law — Protecting Your Wealth the Islamic Way

Imagine your loved ones standing before a court, waiting months for access to what you intended for them — simply because your will didn’t align with Sharia. It’s more common than you think.

When faith and law collide, your family’s peace can hang in the balance. Many Muslim families discover — too late — that their wills and estate plans don’t actually follow Islamic inheritance principles once they enter the court system. The result? Delays, disputes, and decisions that go against Sharia.

Families often discover that their “Islamic will” doesn’t hold up in court. Probate judges follow state law, not Sharia, leaving assets tied up, families divided, and intentions unfulfilled.

The good news? There’s a powerful solution. The Islamic Revocable Living Trust bridges the gap between secular law and divine guidance — protecting your assets, your heirs, and your faith. It’s the apex tool for Sharia-compliant wealth transfer in today’s complex legal world.

For American Muslims, estate planning is a complex fiduciary task that requires harmonizing two separate legal systems: U.S. common law (which grants testamentary freedom) and Sharia inheritance law (which mandates fixed Fara'id shares). Relying solely on a Last Will and Testament guarantees entry into probate, a process that is costly, public, and structurally prone to overriding Islamic distribution mandates. The Islamic Revocable Living Trust (RLT) stands as the most robust, private, and efficient mechanism to achieve both legal validity and spiritual compliance.

TODAYS EMIL

Deconstructing the Probate Trap and the Intestacy Risk

The RLT: A Private, Two-Part Fiduciary Instrument

The Critical Pitfall: Funding and Titling Errors

The Hidden Conflict: Sharia vs. Secular Law

Conclusion and Strategic Self-Assessment

👉 Take the 2-minute Islamic Estate Reality Check and see if your family’s plan is truly protected.

https://islamicestaterealitycheck.scoreapp.com

Take Action Today:

💻 Visit Our Website: www.islamicwillstrust.com

📞 Call Us: 1855-559-4557

📧 Email Us: [email protected]

Deconstructing the Probate Trap and the Intestacy Risk

Probate is the court-supervised judicial process of validating a Will, settling debts, and distributing a deceased individual’s assets.

The Challenge | Legal/Financial Ramifications |

Exposure & Delay | The process is a matter of public record, stripping the family of financial privacy. The average duration is 9 to 24 months, freezing liquidity and delaying crucial support for dependents. |

Cost Center | Attorney fees, executor commissions, and court costs often consume 3% to 7% of the gross estate value. This represents a substantial, avoidable tax on the legacy intended for the heirs. |

Intestacy Risk | Dying without any valid Will or Trust (intestacy) means state law dictates inheritance via rigid formulas that categorically violate Fara'id, potentially awarding assets to distant relatives or non-Muslim family members. |

The Fundamental Sharia Conflict

U.S. state law grants surviving spouses elective shares or rights of survivorship on assets (like jointly titled homes) that often far exceed their fixed Qur’anic portion. A standard Will may attempt to follow Sharia, but the probate process itself and state defaults can challenge or ignore those instructions.

The RLT: A Private, Two-Part Fiduciary Instrument

The Revocable Living Trust (RLT) is a separate legal entity created during the grantor’s lifetime. It offers functional benefits across the entire lifecycle of the estate:

Part A: Lifetime Incapacity Management

Unlike a Will (which is dormant until death), the RLT is active immediately.

Seamless Succession: Should the grantor become mentally or physically incapacitated, the named Successor Trustee immediately assumes control of the Trust assets, without any need for a costly, public Conservatorship or Guardianship court proceeding.

Asset Continuity: Business interests, investment portfolios, and real estate management continue uninterrupted. The Trust maintains tax neutrality while the grantor is alive.

Part B: Post-Mortem Sharia Execution

The RLT's central function is to act as the primary distribution contract for non-probate assets.

Order of Operations: The Trust document explicitly mandates the Islamic order of settlement, ensuring payment of debts (including Huquq Allah like outstanding Zakat or Hajj expenses) and final funeral costs first.

Wasiyyah Implementation: It isolates the legally permissible one-third (1/3) portion for discretionary bequests (e.g., charitable endowments or gifts to non-heirs).

Fara'id Enforcement: The remaining two-thirds (2/3) is distributed privately and immediately by the Successor Trustee according to the meticulously mapped fixed Islamic shares, effectively bypassing state inheritance overrides.

Pro Tip: For married couples, establishing a Joint RLT with specific clauses regarding spousal waivers of statutory elective shares is the most effective legal safeguard to ensure the Sharia distribution schedule is honored.

The Critical Pitfall: Funding and Titling Errors

The efficacy of the RLT is entirely contingent on its funding. The most common and devastating planning failure is neglecting to legally transfer assets into the Trust's name.

Funding Failure: Assets not retitled into the Trust's name remain probate assets subject to the court. The resulting legal duality—where the Trust manages some assets and the court manages others—guarantees maximum cost and delay.

Asset Class | The Mandatory Titling Action | Risk of Failure |

Real Property (Land/Home) | Executing and recording a new Quitclaim or Warranty Deed that transfers title to the Trust's name. | The property must undergo full probate, leading to jurisdictional challenges if out-of-state. |

Financial Accounts | Changing the account title at the institution to "[Grantor Name], Trustee of the [Trust Name] RLT." | Accounts will be frozen upon death, necessitating a court order for access. |

Retirement/Insurance | Changing the Beneficiary Designation Form to name the RLT as the primary beneficiary. | The funds pass directly to the named individual, potentially overriding the Sharia distribution inside the Trust. |

A Trust that is not properly funded is useless. It’s like buying a beautiful cake box but leaving the cake on the counter. The cake still spoils (goes to probate)!

Case Study (Simple Version): A family created a Trust, but they forgot to change the deed on their house. When the owner passed, the family had to go through probate and manage the Trust, resulting in over $12,000 in extra legal fees and eight months of delays!

“The best time to plan your legacy is when you’re full of life and faith. Don’t wait for tomorrow to protect what you’ve built today.”

For Muslim families living in Western countries, one of the biggest challenges in estate planning is the clash between two legal worlds — Sharia law and secular probate law.

When a Muslim passes away, their estate automatically falls under the jurisdiction of the local court system. These courts follow state inheritance laws, not Islamic ones. That means:

The court decides who gets what, based on secular statutes — not Qur’anic shares.

Your estate may be delayed in probate (a lengthy, public, and expensive process).

Family members may end up with different portions than what Islam prescribes.

Even with the best intentions, a traditional will alone often fails to protect your wishes. Why? Because once it enters the legal system, judges are bound by civil law, not religious doctrine.

💔 Real-Life Example

A Muslim father in California created a simple will, naming his eldest son as executor. But after his passing, the court required probate. Since U.S. law doesn’t recognize Sharia-based distribution, the court divided the estate equally among all children — ignoring Qur’anic ratios. The process took over a year, cost thousands in legal fees, and left lasting tension in the family.

This is the jurisdictional conflict — where your faith says one thing, but the law enforces another.

🌙 The Islamic Revocable Living Trust: The Apex Solution

The Islamic Revocable Living Trust (RLT) is a faith-aligned legal instrument designed to bridge these two worlds. It allows Muslims to plan their estates in a way that satisfies both secular legal standards and Sharia inheritance principles.

Here’s How It Works:

Bypasses Probate: Your assets transfer privately, without court involvement. No delays, no public record, no interference.

Ensures Sharia Compliance: You define exactly how your wealth will be distributed according to Qur’anic rules.

Keeps You in Control: You can manage, update, or revoke your trust anytime during your life — and your instructions activate automatically upon your passing.

It’s the apex tool because it doesn’t force you to choose between legal compliance and faith — it honors both.

🌟 Key Benefits of the Islamic Revocable Living Trust

✅ Peace of Mind: Your estate is fully compliant with Sharia and protected under local law.

✅ Avoids Probate: No court delays, no legal fees, no stress for your family.

✅ Privacy and Dignity: Your financial affairs remain confidential — not open to public record.

✅ Family Harmony: Clear instructions mean fewer disputes and more unity.

✅ Ongoing Control: You can amend the trust as your family or circumstances change.

💡 Pro Tip Corner

Simple ways to strengthen your trust and make it truly effective:

🔹 Fund it properly. After setting up your trust, move your assets into it. An unfunded trust can’t protect what it doesn’t own.

🔹 Review it annually. Update it whenever you acquire new property, have children, or experience life changes.

🔹 Add a sadaqah clause. Dedicate a small portion of your estate for charity — it becomes sadaqah jariyah (ongoing reward) that benefits you long after you’re gone.

🔹 Educate your heirs. Make sure your family understands your trust so they can follow it with peace and respect.

Conclusion and Strategic Self-Assessment

🧭 Assessment: Are You Trapped or Safe? 🔒

You’ve just discovered the secret key — the Islamic Revocable Living Trust — your shield against the probate trap. 🛡️

But let’s get real for a moment…

👉 Are you sure your family’s plan is safe?

👉 Or could you be unknowingly walking straight into the very trap you’re trying to avoid? 😬

Here’s the truth: most families think their estate plan is solid — until life proves otherwise. A missing signature here, a forgotten asset there, and suddenly your loved ones are facing months (or even years!) of court delays, stress, and unnecessary costs.

You don’t deserve that. And neither do they. 💔

That’s why we created the Islamic Estate Reality Check — a super-quick, eye-opening quiz that tells you exactly where you stand.

💡 In Just 2 Minutes, You’ll Discover:

✅ If your estate plan truly avoids probate.

✅ Whether your setup is Sharia-compliant and fair to your heirs.

✅ The one or two simple steps to strengthen your legacy — right now.

It’s short, easy, and honestly… kinda fun! 🎯

You’ll walk away with clarity, confidence, and peace of mind knowing your legacy reflects your faith and love for your family. 🌙

👉 Take the 2-minute Islamic Estate Reality Check and see if your family’s plan is truly protected.

https://islamicestaterealitycheck.scoreapp.com

Go ahead — take the quiz today.

Because protecting your legacy isn’t just about wealth… it’s about faith, family, and peace of heart. 💛

🌙 Trust Planning in the Qur’an

In Islam, wealth is not just something we own — it’s something we are entrusted with by Allah ﷻ. The Qur’an teaches that everything we have is an amanah (a sacred trust), and we are responsible for how we manage and pass it on.

“Indeed, Allah commands you to render trusts (amanat) to whom they are due…”

— Surah An-Nisa (4:58)

This verse forms the spiritual foundation of trust planning — reminding believers to ensure their wealth and responsibilities are handled with honesty and justice.

💡 Why It Matters for Estate Planning

When a Muslim creates an Islamic Revocable Living Trust, they are:

✅ Fulfilling their duty to protect their family and heirs.

✅ Ensuring their estate is distributed fairly and in line with Sharia (Islamic law).

✅ Avoiding disputes and injustice after their passing.

“It is prescribed for you, when death approaches one of you, if he leaves wealth, to make a bequest for parents and near relatives according to what is acceptable—a duty upon the righteous.”

— Surah Al-Baqarah (2:180)

This verse encourages proactive planning — not waiting until it’s too late. In modern terms, this means taking practical steps like Creating an Islamic Revocable Living Trust isn’t just smart planning — it’s a spiritual act of stewardship. It’s how you honor your blessings, protect your loved ones, and ensure your legacy continues in peace and accordance with divine law.

🌿 The Spirit of Islamic Trust Planning

At its heart, trust planning in Islam is not about paperwork — it’s about peace of mind.

It’s about ensuring your blessings continue to benefit your loved ones and your community after you’re gone.

💬 Everything you have is a trust from Allah. The question is: how will you honor that trust when it’s time to pass it on?

Don't wait until it's too late to safeguard your hard-earned wealth. The time to act is now! By consulting with asset protection professionals, you can create a robust plan tailored to your unique needs, ensuring financial security for you and your loved ones.

Here's how to get started:

Schedule a Free Consultation: Speak with one of our expert advisors to assess your current situation and identify potential risks. Our team will help you develop a personalized asset protection strategy.

Download Our Comprehensive Asset Protection Guide: Get instant access to valuable insights and practical tips on protecting your assets. This guide will walk you through the essential steps you need to take.

Why Act Now?

Prevent Future Losses: Shield your assets from lawsuits, creditors, and unforeseen financial challenges.

Secure Your Legacy: Ensure that your wealth is preserved for future generations.

Gain Peace of Mind: Rest easy knowing that your financial future is protected.

Take the Next Step: Click the button below to schedule your free consultation or download our guide. Your financial security is too important to delay!

Why Islamic Estate Planning Matters:

Islamic estate planning is essential for:

Preserving Your Legacy: Ensuring your wealth is distributed according to Islamic principles.

Protecting Your Loved Ones: Providing security and clarity for your family’s future.

Fulfilling Religious Obligations: Complying with Shariah law in all aspects of your estate.

Our Unique Approach:

Halal Legacy Shield is dedicated to offering comprehensive estate planning services that respect and uphold Islamic values. Our approach includes:

Wills & Trusts: Drafting documents that reflect your wishes and comply with Islamic laws.

Asset Protection: Ensuring your assets are safeguarded and distributed correctly.

Healthcare Directives: Establishing advance directives that respect your religious beliefs.

Tax Planning: Structuring your estate to minimize tax liabilities while complying with Shariah law.

Exclusive Offer – Act Now!

For a limited time, we are offering a 10% discount on all our Islamic estate planning services. This exclusive offer is our way of supporting you in taking the crucial step towards securing your family's financial future in accordance with Islamic principles.

Benefits You Will Receive:

Personalized Consultation: One-on-one consultation with our expert advisors.

Comprehensive Planning: Custom solutions tailored to your unique needs.

Continuous Support: Ongoing guidance and updates to your estate plan as needed.

Peace of Mind: Assurance that your legacy is preserved in line with Shariah law.

Take Action Today:

💻 Visit Our Website: www.islamicwillstrust.com

📞 Call Us: 1855-559-4557

📧 Email Us: [email protected]

May Allah (SWT) bless you with peace and prosperity, and may your legacy continue to benefit your loved ones and the Ummah.

Warm Regards,

The Halal Legacy Shield Team

Disclaimer

This article is intended to provide general information and should not be construed as legal or financial advice. Consult with professionals to evaluate your specific needs and develop a personalized asset protection plan.

Reply