- Halal Legacy Shield

- Posts

- Mastering Islamic Estate Planning: Navigating Common Mistakes and Effective Solutions

Mastering Islamic Estate Planning: Navigating Common Mistakes and Effective Solutions

Mastering Islamic Estate Planning: Navigating Common Mistakes and Effective Solutions

Dear Halal Legacy Shield Community,

Assalamu Alaikum,

We pray this message finds you in the best of health and iman.

Planning for the future is more than just securing assets; it's about ensuring that your legacy aligns with your values and benefits your loved ones in the way you intend. Islamic Estate Planning is a critical aspect of this journey, yet it’s often overlooked or misunderstood. This week, we're diving deep into this essential topic, focusing on the common mistakes that can derail your intentions and the practical, Sharia-compliant solutions to avoid them.

Whether you're just beginning your estate planning journey or looking to refine your existing plans, our insights will help you navigate this complex process with confidence, ensuring your legacy remains true to your faith.

Warm Regards,

Yasir Zia

Halal Legacy Shield

TODAY’S EMAIL

Avoiding Common Mistakes in Islamic Estate Planning

Navigating the Path of Islamic Estate Planning:

Securing Your Home: The Essential Role of Estate Planning in Asset Protection(Strategy)

Facts about Islam this week (a Misbelief)

Avoiding Common Mistakes in Islamic Estate Planning

Welcome back to HALAL LEGACY SHIELD! In this edition, we address a crucial aspect of estate planning: identifying and avoiding common pitfalls in Islamic estate planning. While planning your estate in accordance with Sharia law ensures compliance with Islamic principles, there are several mistakes that can jeopardize your efforts. Let's explore these pitfalls and provide practical advice on how to avoid them.

1. Procrastination in Drafting a Will

Pitfall: One of the most common mistakes is delaying the drafting of a will. Many people postpone this essential task, thinking they have ample time or fearing it will bring bad luck.

How to Avoid: Understand that drafting a will is a religious obligation and a responsible act. Start the process as soon as possible, and regularly review and update your will to reflect any changes in your circumstances.

2. Ignoring Sharia Guidelines

Pitfall: Failing to adhere to the specific allocation of shares for heirs as prescribed by the Quran can invalidate your will.

How to Avoid: Familiarize yourself with the Sharia guidelines for inheritance and ensure your will reflects these rules. Consulting with an Islamic legal expert can help you draft a compliant will.

3. Overlooking Debt Settlement

Pitfall: Neglecting to account for and settle outstanding debts before distributing the estate is a serious error.

How to Avoid: Clearly list all debts and liabilities in your will and prioritize their settlement before any inheritance is distributed. This is both a religious and ethical obligation.

4. Failing to Appoint a Competent Executor

Pitfall: Choosing an executor who is not trustworthy, capable, or knowledgeable about Islamic inheritance laws can lead to mismanagement of the estate.

How to Avoid: Select an executor who possesses the necessary qualities and knowledge to administer your estate according to Sharia principles. Consider appointing a backup executor as well.

5. Ignoring Tax Implications

Pitfall: Overlooking the tax implications of your estate can result in significant financial losses for your heirs.

How to Avoid: Work with a financial advisor who understands both Islamic and local tax laws to structure your estate plan in a tax-efficient manner.

6. Not Making Provisions for Guardianship

Pitfall: Failing to appoint guardians for minor children can leave their future uncertain and may result in court-appointed guardianships.

How to Avoid: Clearly state in your will the individuals you wish to appoint as guardians for your minor children, ensuring they share your values and beliefs.

7. Inadequate Documentation of Assets

Pitfall: Poor documentation of assets can lead to confusion, disputes, and even loss of assets.

How to Avoid: Maintain a comprehensive and updated list of all your assets, including properties, bank accounts, investments, and personal belongings. Ensure this information is included in your will.

8. Excluding Charitable Bequests

Pitfall: Neglecting to allocate a portion of your estate to charitable causes can be a missed opportunity for ongoing philanthropy.

How to Avoid: Consider including charitable bequests in your will, up to the one-third limit allowed by Sharia law. This can support causes you to care about and ensure your legacy continues to benefit others.

9. Lack of Communication with Heirs

Pitfall: Not discussing your estate plan with your heirs can lead to misunderstandings and disputes after your passing.

How to Avoid: Hold family meetings to explain your estate plan and the reasons behind your decisions. Open communication can help manage expectations and reduce conflicts.

10. Not Updating the Will

Pitfall: Life changes such as marriage, divorce, births, and deaths can render your will outdated and ineffective if not updated regularly.

How to Avoid: Review and update your will periodically or whenever significant life events occur. This ensures that your estate plan remains relevant and effective.

Conclusion

Avoiding these common pitfalls in Islamic estate planning requires diligence, knowledge, and proactive steps. By being aware of these mistakes and taking measures to prevent them, you can ensure that your estate is managed and distributed in accordance with Islamic principles, providing peace of mind and security for your loved ones. Stay tuned for next week's edition, where we will explore the role of executors in Islamic estate planning. May your journey in estate planning be blessed and guided by wisdom and faith.

As Muslims navigate the complexities of modern financial and legal landscapes, the importance of Islamic estate planning becomes increasingly evident. Rooted in the principles of Shariah, Islamic estate planning ensures that one’s wealth is distributed according to divine guidance, providing peace of mind and fulfilling religious obligations. Unlike conventional estate planning, Islamic estate planning requires adherence to specific religious laws, making it essential for Muslims to have a tailored plan in place.

Understanding Islamic Estate Planning

Islamic estate planning involves managing one's assets during their lifetime and distributing them after death in compliance with Islamic laws. It is a crucial aspect for Muslims, as it not only helps in fulfilling religious duties but also ensures the financial security and harmony of one’s family. The key distinction between Islamic and conventional estate planning lies in the adherence to Shariah laws, particularly the fixed share system of inheritance known as Faraid.

Key Components of Islamic Estate Planning

Wills (Wasiyyah)

A will in Islamic estate planning allows individuals to distribute up to one-third of their estate to non-heirs or for charitable purposes. This component ensures personal wishes align with Islamic values, such as supporting charitable causes or benefiting someone in need. For example, a person might allocate a portion of their estate to a local mosque or Islamic charity.

Trusts

Trusts in Islamic estate planning can be used to manage assets, providing for beneficiaries over time. They can be particularly beneficial for managing assets for minor children or ensuring continued support for family members. Trusts must comply with Shariah principles, avoiding interest-based investments. and protect minor children.

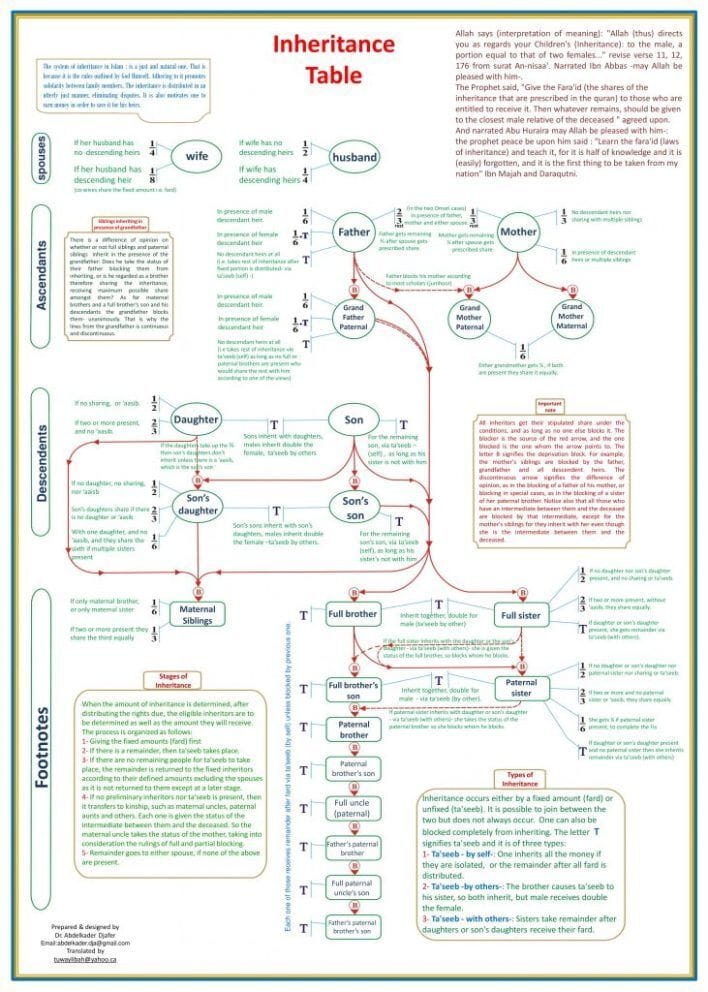

Inheritance Laws (Faraid)

Faraid dictates the fixed shares for heirs, ensuring a fair distribution of wealth. For instance, a son typically receives twice the share of a daughter. Understanding and implementing Faraid correctly is crucial, as misunderstandings can lead to disputes and religious non-compliance.

Charitable Gifts (Zakat and Sadaqah)

Muslims are encouraged to give Zakat and Sadaqah as part of their estate planning. These charitable gifts not only purify wealth but also ensure a lasting legacy of goodwill. For example, incorporating a recurring donation to a charitable organization in the estate plan can have long-term community impacts.

Powers of Attorney

Assigning powers of attorney allows individuals to designate someone to make financial and legal decisions on their behalf if they become incapacitated. This is a proactive step to ensure one’s affairs are managed in accordance with Islamic principles.

Healthcare Directives

Healthcare directives enable individuals to outline their medical care preferences, ensuring decisions align with Islamic values. This component is essential for making end-of-life decisions that respect one’s faith.

Common Mistakes and Misconceptions

A common mistake in Islamic estate planning is the failure to document all assets or misunderstanding the application of Faraid. Misconceptions often arise regarding the one-third rule in wills, leading to allocations that exceed permissible limits. Such errors can result in disputes and legal complications.

The Importance of Professional Guidance

Given the complexities and religious obligations involved, seeking professional guidance is paramount. Halal Legacy Shield offers expert services to help Muslims create estate plans that comply with both Islamic principles and legal standards. Their knowledgeable advisors can provide tailored solutions, ensuring that the intricacies of Islamic estate planning are expertly navigated.

In conclusion, Islamic estate planning is a vital practice for Muslims, encompassing financial management and religious compliance. By understanding and integrating key components—such as wills, trusts, and Faraid—Muslims can ensure their legacy is preserved in accordance with divine guidance. Engaging with professionals like those at Halal Legacy Shield can provide the necessary expertise to craft a comprehensive and compliant estate plan, safeguarding both spiritual and familial well-being.

Securing Your Home: The Essential Role of Estate Planning in Asset Protection

The concept of estate planning is pivotal for individuals seeking to secure their assets and ensure the smooth transfer of wealth according to their wishes. Among these assets, your personal residence often represents both a significant financial investment and a cherished home. Proper estate planning not only safeguards this asset but also provides peace of mind by shielding it from potential threats such as creditors, divorce settlements, and lawsuits.

Understanding Estate Planning and Asset Protection

Estate planning involves creating a comprehensive strategy for managing and transferring your assets upon incapacitation or death. It is a proactive measure that addresses how your property will be distributed, who will manage it, and how it can be protected from various legal claims. Protecting your personal residence is a critical component of this process, as it can be vulnerable to external threats without proper planning.

Laws and Regulations in Estate Planning

Estate planning is governed by specific laws and regulations that vary by state or country. For instance, in the United States, probate laws dictate how estates are administered, and assets are transferred after death. This process can be time-consuming and public, leaving your estate susceptible to claims from creditors.

Additionally, legislation regarding property ownership and transfer can impact how your personal residence is passed on to heirs. Understanding these legal frameworks is essential for ensuring that your estate plan is both effective and compliant.

Tools and Strategies for Protecting Your Residence

To protect your personal residence, several tools and strategies can be employed, each offering unique benefits:

Trusts

Establishing a trust is one of the most effective ways to protect your home. By placing your residence in a trust, you can shield it from creditors and potential claims from beneficiaries’ creditors, divorce settlements, or lawsuits. Trusts allow you to retain control over your property during your lifetime while ensuring that it is transferred smoothly and privately to your beneficiaries after your death. For example, a revocable living trust can help avoid probate and maintain privacy, while an irrevocable trust provides stronger protection against creditors.

Insurance Policies

Homeowners insurance is essential for protecting your residence against unforeseen events such as natural disasters or theft. Additionally, umbrella insurance policies can offer extra liability coverage, safeguarding your assets from significant claims or legal disputes.

Homestead Exemptions

In certain jurisdictions, homestead exemptions protect a portion of your home's value from being claimed by creditors. This legal provision can prevent forced sales to satisfy debts, offering a crucial layer of security. It's vital to understand the specific homestead exemption rules applicable in your area, as they can vary significantly.

Real-World Application

Consider a homeowner who places their residence into a trust to protect it from potential legal claims. By doing so, they can ensure that the property is not only managed according to their wishes but also remains safe from external threats, such as lawsuits against beneficiaries. This strategic move preserves the home's value and secures it for future generations.

Conclusion

Protecting your personal residence through estate planning is a crucial step in securing your assets and ensuring a smooth transition of your wealth. By understanding the relevant laws and employing tools like trusts, insurance policies, and homestead exemptions, you can safeguard your home from creditors and legal threats. Given the complexities of estate planning, seeking professional guidance from experts like those at Halal Legacy Shield can ensure that your plan is comprehensive and tailored to your needs. Engaging with knowledgeable advisors can provide the expertise necessary to protect your legacy and offer peace of mind for you and your family.

Misbelief – Islam is Unfair at Women’s Inheritance

The fact that a woman’s estate is only half the share of a man is a matter of concern and injustice towards women to those who do not have full knowledge of men and women’s financial responsibilities.

The logic behind less share for the woman than a man

in Islam, a woman has no financial obligation, and the economic responsibility lies on the man’s shoulders. Before a woman is married, the father or brother is responsible for looking after the woman’s lodging, boarding, clothing, and other financial requirements. After she is married, it is the duty of the husband or the son. Islam holds the man financially responsible for fulfilling the needs of his family. For example, if a man dies, leaving about $150, 000 for the children (I.e., one son and one daughter), the son inherits $100,000 and the daughter only $50,000. From the $100,000 that the son inherits, as his duty towards his family (his wife and children), he may hate to spend a significant portion on say about eighty thousand. Thus, he has a small percentage of inheritance, say about $20,000 left for himself. On the other hand, the daughter, who inherits $50,000, does not have to spend a single penny on anybody (her husband or children). She can keep the entire amount for herself.

Would you prefer inheriting $100,000 dollars and spending $70,000 to $80,000 from it on your obligations, or inheriting $50,000 and having the entire amount to yourself?

The Quran contains specific and detailed guidance regarding the division of inherited wealth among the rightful beneficiaries as follows:

The female sometimes inherits the same or more than their male counterparts

In the most of the cases, a woman inherits half of what her male counterpart inherits. However, this is not always the case. In case the deceased has left no ascendant or descendant but has left the uterine brother and sister, each of the two inherits 1/6th. If the deceased has left no children, both the parents get an equal share and inherit 1/6th each. In some instances, a woman can also inherit a share that is double that of the male, if the deceased is a woman who has left no children, brothers, or sisters and is survived only by her husband, mother, and father, the husband inherits half the property. In contrast, the mother inherits 1/3rd and the father the remaining 1/6th. In this case, the mother inherits a share that is double that of the father.

The female usually inherits half the share of that of the male counterpart. It is valid that, as a rule, the female inherits a share that is half that of the male in most cases. For instance, in the following circumstances:

1. A daughter inherits half of what the son inherits.

2. The wife inherits 1/8th and the husband 1/4th if the deceased has no children.

3. The wife inherits 1/4th and the husband 1/2 if the deceased has children.

4. If the dead has no ascendant or descendant, the sister inherits half of the brother.

Conclusion inheritance in Islam is the most comprehensive

The Islamic system has made ‘need ‘ the essential criterion for preference in inheritance, the son’s duties and financial obligations under the Shariah(legislation) of Islam are more than those of his sister. He is financially responsible for his wife, and her wedding gift, and provides for her and the children. Men are responsible for parents, other ascendants, and descendants see the detailed chart below. However, the women are more likely to have someone, a mahram (father, brother, husband, son. Grandson, etc.) to provide for her and not the other way round Islamic inheritance laws are the most generous a most universally liberal to ascendants to descendants, as illustrated in the detailed chart below

Don't wait until it's too late to safeguard your hard-earned wealth. The time to act is now! By consulting with asset protection professionals, you can create a robust plan tailored to your unique needs, ensuring financial security for you and your loved ones.

Here's how to get started:

Schedule a Free Consultation: Speak with one of our expert advisors to assess your current situation and identify potential risks. Our team will help you develop a personalized asset protection strategy.

Download Our Comprehensive Asset Protection Guide: Get instant access to valuable insights and practical tips on protecting your assets. This guide will walk you through the essential steps you need to take.

Why Act Now?

Prevent Future Losses: Shield your assets from lawsuits, creditors, and unforeseen financial challenges.

Secure Your Legacy: Ensure that your wealth is preserved for future generations.

Gain Peace of Mind: Rest easy knowing that your financial future is protected.

Take the Next Step: Click the button below to schedule your free consultation or download our guide. Your financial security is too important to delay!

Why Islamic Estate Planning Matters:

Islamic estate planning is essential for:

Preserving Your Legacy: Ensuring your wealth is distributed according to Islamic principles.

Protecting Your Loved Ones: Providing security and clarity for your family’s future.

Fulfilling Religious Obligations: Complying with Shariah law in all aspects of your estate.

Our Unique Approach:

Halal Legacy Shield is dedicated to offering comprehensive estate planning services that respect and uphold Islamic values. Our approach includes:

Wills & Trusts: Drafting documents that reflect your wishes and comply with Islamic laws.

Asset Protection: Ensuring your assets are safeguarded and distributed correctly.

Healthcare Directives: Establishing advance directives that respect your religious beliefs.

Tax Planning: Structuring your estate to minimize tax liabilities while complying with Shariah law.

Exclusive Offer – Act Now!

For a limited time, we are offering a 10% discount on all our Islamic estate planning services. This exclusive offer is our way of supporting you in taking the crucial step towards securing your family's financial future in accordance with Islamic principles.

Benefits You Will Receive:

Personalized Consultation: One-on-one consultation with our expert advisors.

Comprehensive Planning: Custom solutions tailored to your unique needs.

Continuous Support: Ongoing guidance and updates to your estate plan as needed.

Peace of Mind: Assurance that your legacy is preserved in line with Shariah law.

Take Action Today:

💻 Visit Our Website: www.islamicwillstrust.com

📞 Call Us: 1855-559-4557

📧 Email Us: [email protected]

May Allah (SWT) bless you with peace and prosperity, and may your legacy continue to benefit your loved ones and the Ummah.

Warm Regards,

The Halal Legacy Shield Team

Disclaimer

This article is intended to provide general information and should not be construed as legal or financial advice. Consult with professionals to evaluate your specific needs and develop a personalized asset protection plan.

Reply